The real estate market across Northern Virginia, D.C., and Maryland is entering another period of transition — one marked by economic volatility, global policy uncertainty, rising costs, and structural changes within the federal workforce. While these conditions can appear overwhelming, they also offer strategic openings for well-positioned property owners, investors, and vacation homeowners.

At Chambers Theory Property Management, Home Theory Sales Team, and Stay with Chambers Theory, we believe in unified insight. By sharing data across all service lines — leasing, sales, vacation management, and home watch — we empower our clients to respond with intelligence and agility, no matter what’s happening in the market.

Short-Term Uncertainty, Long-Term Strength in the DMV

We are in a period of short-term instability — and that’s evident in the stock market, consumer spending patterns, and federal and contracting job security. But the broader forces that drive people to the DMV region remain unchanged:

- Government infrastructure, international diplomacy, cybersecurity, and tech continue to attract residents and capital.

- Educational institutions and healthcare centers continue to create long-term economic gravity.

- The housing shortage hasn’t disappeared — and in some ways, it's being exacerbated by new policies.

Our belief is clear: While short-term turbulence may affect timing and tactics, long-term fundamentals favor ownership, investment, and strategic portfolio growth in the region.

Tariffs Historic Implication: Inflating Costs and Constraining New Housing Supply

Historically, tariffs on imported construction materials have resulted in higher project costs and constraints on the housing supply — and while the full impact of the current wave of U.S.-China tariffs has yet to be felt, there are strong indicators that the industry is preparing for disruption. Past tariff cycles give us a clear picture of what may lie ahead, particularly in regions like the DMV where high housing demand intersects with global supply chains. According to CliftonLarsonAllen (CLA), the 2018 steel and aluminum tariffs led to sharp increases in pricing and significant project delays.

impact of the current wave of U.S.-China tariffs has yet to be felt, there are strong indicators that the industry is preparing for disruption. Past tariff cycles give us a clear picture of what may lie ahead, particularly in regions like the DMV where high housing demand intersects with global supply chains. According to CliftonLarsonAllen (CLA), the 2018 steel and aluminum tariffs led to sharp increases in pricing and significant project delays.

Even before clear inflation hits the books, contractors and vendors are already building risk premiums into their bids — planning ahead for material delays and pricing volatility. Some key historical takeaways and early signals include:

- Steel and aluminum tariffs in 2018 caused budget overruns of 10% or more on many projects, with ripple effects across both commercial and residential construction sectors.

- Lumber prices in Virginia have swung as much as 30% in recent years, contributing to cost uncertainty on everything from framing to fencing to basic renovations.

- Supply chain bottlenecks during past tariff cycles led to slower timelines and vendor shortages, increasing property downtime and project carry costs for investors and homeowners alike.

While we are not yet seeing widespread impacts from the latest tariff announcements, the construction and property maintenance industries are already bracing for a familiar cycle. The Chambers Theory solution? Our internal ecosystem tracks vendor pricing, repair timelines, and labor availability across three divisions — giving clients advanced notice and flexible alternatives when the market tightens.

New Construction Slowdown = Resale Market Surge

While it is too early to tell if heightened tariffs will remain and cause a slowdown in new construction projects due to increased material costs and uncertainties in the supply chain, this potential situation exacerbates the existing housing shortage in the DMV area.

While it is too early to tell if heightened tariffs will remain and cause a slowdown in new construction projects due to increased material costs and uncertainties in the supply chain, this potential situation exacerbates the existing housing shortage in the DMV area.

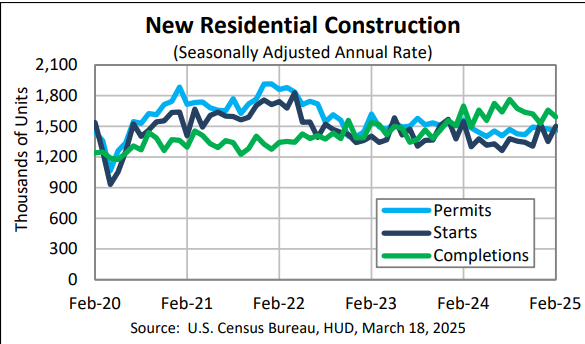

According to a joint report put out by the US Census Bureau and the US Dept of HUD, national housing “starts” (actively beginning construction) were down 2.9% from February 2024 and building permits were down 6.8% from February 2024. National trends are not always reflective of our local economics, typically when it comes to job security and the housing market, however it is prudent to watch what is happening across the area, especially if our area’s strong job stability starts to falter.

Property owners may find opportunities, as limited new housing supply can drive up the value of existing homes. However, they must also contend with higher renovation and maintenance costs, which can affect profitability and long-term investment strategies. That’s where Chambers Theory Property Management and the Home Theory Sales Team align: clients are able to seamlessly convert long-term rentals or underused second homes into market-ready listings, with property condition insights already in hand. Meanwhile, Stay with Chambers Theory can help bridge the income gap during the transition, using short-term rental strategies to generate cash flow while prepping for sale.

Property owners may find opportunities, as limited new housing supply can drive up the value of existing homes. However, they must also contend with higher renovation and maintenance costs, which can affect profitability and long-term investment strategies. That’s where Chambers Theory Property Management and the Home Theory Sales Team align: clients are able to seamlessly convert long-term rentals or underused second homes into market-ready listings, with property condition insights already in hand. Meanwhile, Stay with Chambers Theory can help bridge the income gap during the transition, using short-term rental strategies to generate cash flow while prepping for sale.

DOGE & The State Department: Federal Cuts Are Changing the Housing Map

The federal government employs one in three residents in parts of Northern Virginia — and that makes agency-level staffing changes a major force in the regional housing market.

The Department of Government Efficiency (DOGE), spearheaded by Elon Musk and empowered under the Trump administration, is currently executing a sweeping plan to reduce the size of the federal workforce. According to InsideNoVa, this has already triggered anxiety across Northern Virginia, with local leaders bracing for thousands of job cuts — particularly in defense, diplomacy, and technology roles.

For many of our clients — including Foreign Service Officers and State Department personnel — this uncertainty hits close to home:

- Reuters reported that U.S. embassies were directed in February 2025 to prepare for up to 10% staffing cuts, affecting both Americans abroad and the housing landscape at home (source).

- There’s also concern about the elevation of junior diplomats into senior roles, creating further organizational shakeups and potential rotations, transfers, or buyouts.

But the story isn’t all one-sided. Return-to-office mandates are still in place for many government roles, sustaining demand in core metro areas. And not all agencies are shrinking — some are being consolidated, not cut, which may lead to relocations rather than layoffs.

By connecting market signals from tenants, buyers, contractors, and guests, we help all of our clients anticipate where demand is shifting — and how to align their real estate strategy with it.

Vacation Travel Is Changing — and So Is the Opportunity for Local Homeowners

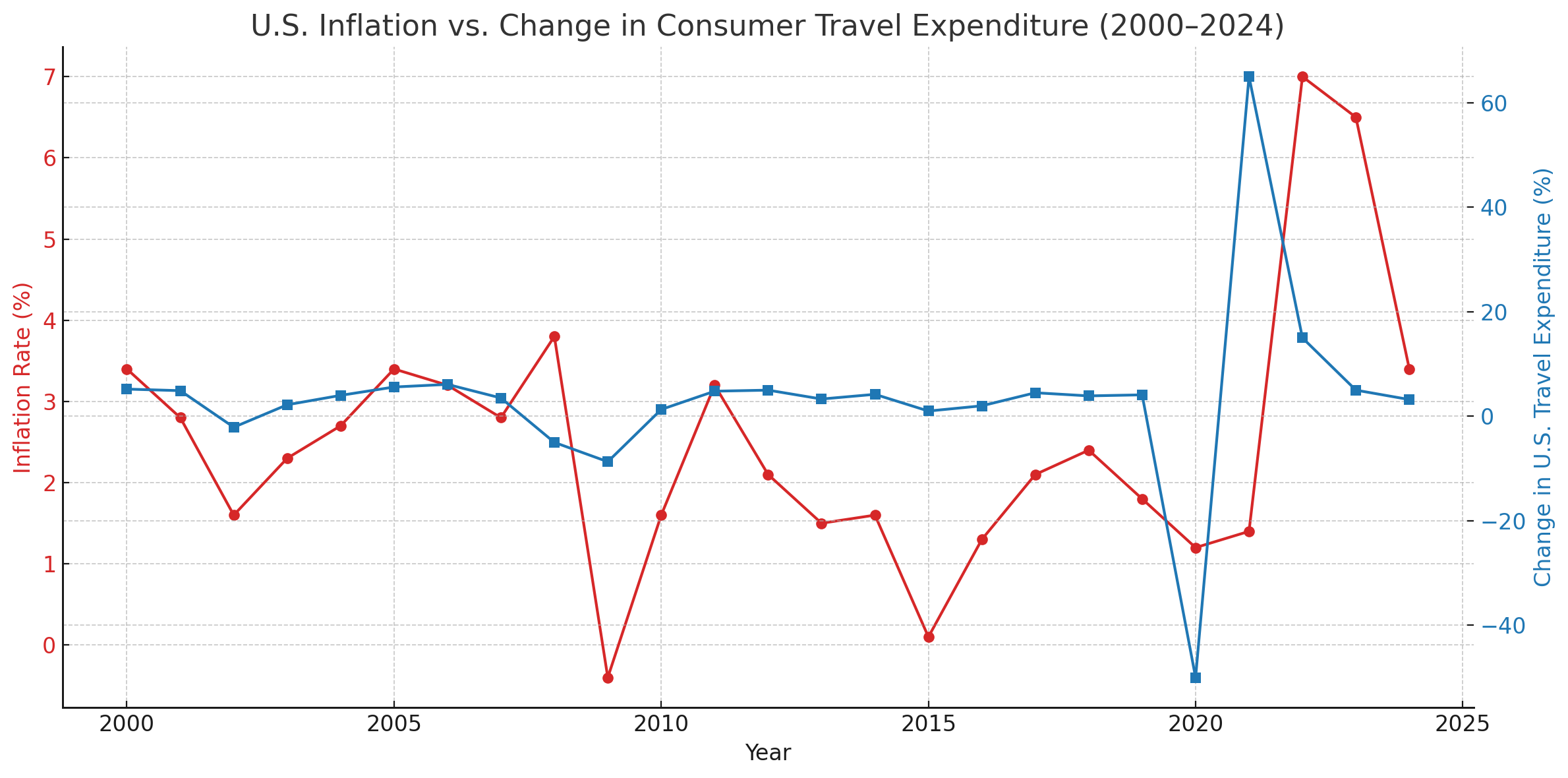

Inflation and economic uncertainty are also changing how Americans vacation. Instead of flying across the country or booking international resorts, more travelers are staying closer to home, opting for weekend retreats and budget-friendly experiences. During the 2008 Great Recession, domestic leisure travel dropped by nearly 5%, while international travel fell by over 9%, according to the U.S. Travel Association. And then as recently as 2022, amid high inflation and post-COVID uncertainty, many Americans scaled back travel budgets even while trip volumes rebounded — shifting toward shorter, less expensive trips. This trend plays right into the strength of properties in

travelers are staying closer to home, opting for weekend retreats and budget-friendly experiences. During the 2008 Great Recession, domestic leisure travel dropped by nearly 5%, while international travel fell by over 9%, according to the U.S. Travel Association. And then as recently as 2022, amid high inflation and post-COVID uncertainty, many Americans scaled back travel budgets even while trip volumes rebounded — shifting toward shorter, less expensive trips. This trend plays right into the strength of properties in

- Lake Anna

- Western Loudoun and Clarke Counties

- Shenandoah Valley

With Stay with Chambers Theory, clients are able to convert second homes into income-producing vacation rentals. Our team manages everything, from marketing to guest relations — while also providing home watch and concierge services that maintain long-term property value. We utilize our specialized pricing algorithm, tailored to the property and the unique characteristics that make it a desirable vacation home.

Traditionally, Americans rarely eliminate vacation travel completely. With the exception of the COVID pandemic which restricted consumers ability to travel and then the ensuing “opening up” that sky rocketed travel expenditure, typically US consumers are still spending approximately the same in travel expenditures. Today’s consumers are looking for curated experiences at the most affordable price. Our team can connect you with local business owners to create experience packages to enhance your rental listings.

What’s more: we share occupancy data and guest feedback across platforms, helping our clients understand what drives bookings — and how that could translate to a potential future sale or investment pivot.

A Shared Strategy for a Fragmented Market

What makes this moment unique is not just the uncertainty — but the interconnection between so many variables:

- Tariffs raising contractor costs

- Workforce reductions shifting neighborhood demand om areas typically immune to the issue.

- Construction delays inflating resale prices again in a short period of time (2021-2022 Market Boom)

- Vacation travel patterns driving new income model potential in our local area.

By operating three tightly integrated brands, Chambers Theory helps our clients see the entire picture. Whether you’re trying to time a sale, scale a rental portfolio, prep for overseas travel, or retire into a vacation home — we provide a clear line of sight across leasing, selling, and holding decisions.

Conclusion: We See What Others Miss

We can’t control global policy, interest rates, or political restructuring — but we can anticipate the impact. And that’s where Chambers Theory delivers value far beyond traditional property services. If you're a Foreign Service Officer planning a tour departure, a landlord bracing for contractor cost hikes, a homeowner considering listing, or simply trying to protect your property in uncertain times — we’re here, with answers.

Chambers Theory Property Management. Home Theory Sales Team. Stay with Chambers Theory. One team, one strategy, your advantage.