The Most Significant yet Under-Reported Reason for Rising Home-Repair Costs in 2025 and other factors affecting the management of your real estate

Almost all of you have experienced an increase in same-service costs for home-related repairs and maintenance in 2025. Likely you also experienced delays in projects too… even for “simple” tasks. Many of you have noticed, and some of you have even questioned Why?

“Why are there delays in getting a 2nd estimate?

- AND/OR –

“Why is it taking so long to complete the repair?”

- AND/OR –

“Why was this repair so expensive?”

One of my favorite paradoxes: “The only constant in the Universe… is change.” Chambers Theory has its fingers on the pulse of the market and is persistently asking the questions: What is happening, what has changed? What does the data say? WHY is it happening? How can we create advantage for our clients within these new market dynamics? How do we ensure compliance with jurisdictional requirements and changes to code and law? We must constantly adapt to the market to ensure we lead the way in adding service value of property management through optimizing the outcomes of your real estate management. How must we evolve to reduce risk and liability and maximize the opportunity for value and reward?

Immigration Policy ---> Construction Labor Shortages ---> Delays & Rising Service Costs

It’s that simple… and yet, WOW, is it causing lot of economic complications. Below are the statistics with analysis and a focus on the Washington DC Metropolitan Region.

Immigration Enforcement and Labor Force Reduction

In 2025, approximately 1.2 million immigrants have exited the U.S. labor force amid increased enforcement and status expirations. Because immigrants make up around one-third of the construction workforce (and even higher when considering the unreported small home services industry contractors), this has had immediate effects on any homeowner or rental property investor needing maintenance to their home.

Analysts still forecast additional labor losses as temporary protections expire, fewer immigrant workers are available right now, and fewer future arrivals. (Yahoo, AP News) Policy trackers also estimate hundreds of thousands losing temporary protections by this month, shrinking labor participation even further. (FWD.us)

Hiring Challenges and Project Delays

A late-August national survey (AGC/NCCER) found that 92% of construction firms and also smaller home services contractors have had difficulty filling vacated positions. 45% of respondents also reported project delays, and nearly one-third acknowledging direct impacts from immigration enforcement, including in the Washington, DC metropolitan area, which is contributing to project backlogs and rising service costs but also labor audits, detentions, and fear among crews that disrupt day-to-day scheduling. (agc.org, AGC News, Engineering News-Record)

Local Dynamics in Washington, DC Metro

The Washington, DC metro area continues to show strong demand for construction and home services, yet the available labor reduction situation has been exacerbated by enforcement actions. Particularly in Northern Virginia & DC, enforcement actions have recently spooked the region, including reports last week of multiple construction workers detained in Alexandria’s Chirilagua neighborhood, have lead to heightened fear and absentee workers, and cause local delays as many workers are discouraged (including those with status) from showing up. (NBC4 Washington)

Priority of higher scope of work jobs

Shortages force contractors to triage labor toward high-value or urgent projects, delaying routine maintenance and smaller repairs. Industry data for Q2 2025 show fewer contracting jobs booked, yet invoice sizes increased. Construction median revenue also rose. This indicates companies are prioritizing the more profitable jobs and higher priced projects due to constrained resources, and putting smaller, lower-value projects on the backburner.

Rising Prices and Cost Pass-Through

Wage data from the Bureau of Labor Statistics show construction hourly earnings have increased. Service inflation more broadly remains high, with services excluding energy costs up 3.6% year-over-year. Specific household-related services also rose. These higher wages and inflationary pressures translate into increased homeowner costs and may be even more amplified in the DC region compared to national data.

What this means for the Washington DC Metro’s home repair & home services market (Q4 2025 outlook)

The DC metropolitan region is likely to experience continued labor shortages and enforcement disruptions through Q4 2025 and early 2026. Homeowners (and property managers) should expect extended wait times, prioritization of urgent work, and persistently elevated prices. Chambers Theory is holding the line with contractors in our policy to provide our clients with free estimates on repairs, however, without policy changes or an influx of new labor willing (and hopefully skilled) to perform home services jobs, the current imbalance between labor supply and strong regional demand may disrupt old policy and cause us to shift strategically to align with the dynamics in the marketplace and find other avenues to achieve prompt repairs and reasonable pricing.

- Expect scheduling delays: With enforcement actions still active in the region and hiring pipelines thin, contractor lead times are likely to remain extended, especially for small and mid-sized non-emergency projects.

- Tendency towards more urgent, higher-value work: Contractors will keep prioritizing emergency repairs, life-safety, and high-value maintenance. Data shows fewer bookings but higher invoices, which matches on-the-ground rationing of scarce labor.

- Upward price pressure persists: Wage growth plus existing services inflation imply elevated quotes for homeowners and property managers through year-end.

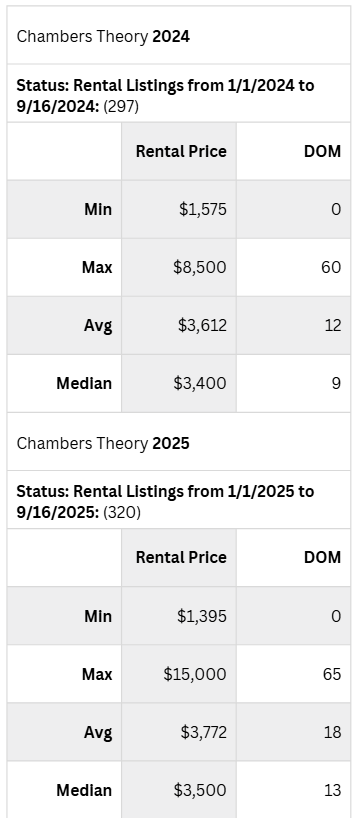

- Slower Lease up timelines: Delayed repairs in occupancy turnovers and “Make Ready” home marketing improvements could lean on additional listing days on market and possibly increase vacancy days too. Looking at the data below, you’ll see Chambers Theory rental listing statistics from the January 1 to September 16 calendar-period for 2024 compared with the same-period rental listing data of 2025. While Chambers Theory has found a higher average rent in 2025 (+$160/month higher average) it has also taken an additional 6 days, on average, to procure a lease in 2025 when compared with 2024.

Key Statistics & Sources

- ≈1.2 million immigrants out of the U.S. labor force this year (preliminary) — reported by Yahoo/AP/ABC. (Yahoo, AP News)

- More than 33% of U.S. construction and home services workers are/were immigrants. (Forbes)

- 92% of contractors for construction and home services are having difficulty hiring; 45% say labor shortages are delaying projects; And at least 1/3 report impacts from immigration enforcement (AGC/NCCER survey; Aug 25–28, 2025). (agc.org, AGC News, Engineering News-Record)

- DC area enforcement: last week multiple construction workers were detained in Alexandria’s Chirilagua; local leaders and residents report broader sweeps. (NBC4 Washington)

- Home-service pricing dynamics: Contracting average invoice size +6.8% YoY; Construction median revenue +6.3% YoY (Q2 2025). (Jobber)

- Chambers Theory DMV leasing performance data: BrightMLS.com